This is the course project for Statistical learning course I took in GMU. I explore how to use recurrent neural network for sequential data modeling, specific using Long Short-Term Memory (LSTM) networks to make stock market predictions. This LSTM model was inspirded by the following post Stock Market Predictions with LSTM in Python. The plot in this post can be found in Colah's blog. Colah did great job for explaining LSTM. Check out his blog Understanding LSTM Networks for more details about LSTM.

Import module first

from yahoofinancials import YahooFinancials

import numpy as np

import matplotlib.pyplot as plt

import datetime as dt

import pandas as pd

from sklearn.preprocessing import MinMaxScaler

from keras.models import Sequential

from keras.layers import Dense

from keras.layers import LSTM

from keras.layers import Dropout Using TensorFlow backend.Read Stock Price Data from Yahoo Finance

yahoo_financials = YahooFinancials('TSLA')

stock = yahoo_financials.get_historical_price_data("2012-01-01", "2019-05-01", "daily")['TSLA']

data = pd.DataFrame(stock['prices']).iloc[:, [1,3,4,5,6]]

data.formatted_date = pd.to_datetime(data.formatted_date)

data = data.set_index('formatted_date')

data.tail()| close | high | low | open | |

|---|---|---|---|---|

| formatted_date | ||||

| 2019-04-24 | 258.660004 | 265.320007 | 258.000000 | 263.850006 |

| 2019-04-25 | 247.630005 | 259.000000 | 246.070007 | 255.000000 |

| 2019-04-26 | 235.139999 | 246.679993 | 231.130005 | 246.500000 |

| 2019-04-29 | 241.470001 | 243.979996 | 232.169998 | 235.860001 |

| 2019-04-30 | 238.690002 | 244.210007 | 237.000000 | 242.059998 |

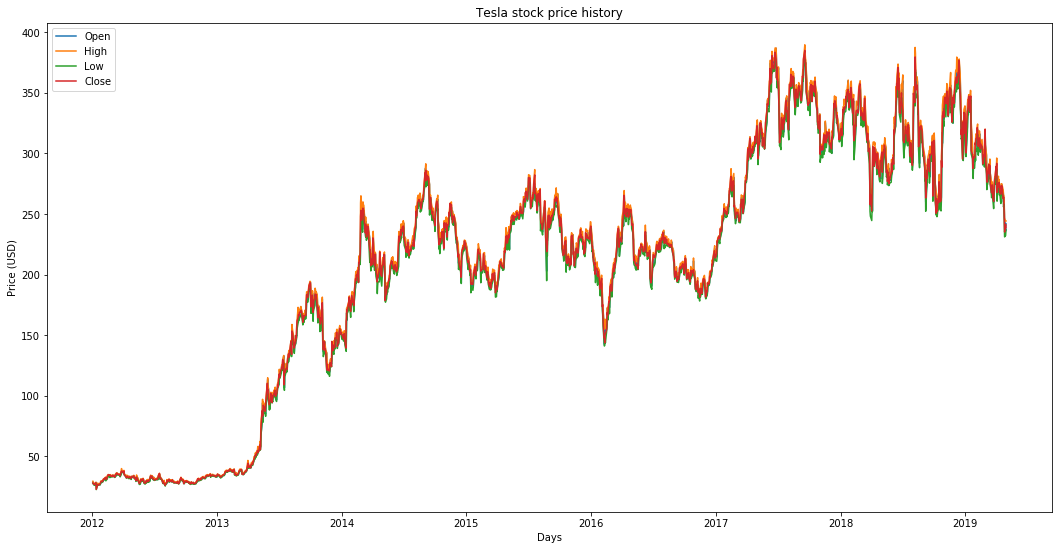

Plot open, close, low, high stock prices

The reason I picked tesla is that this graph is bursting with different behaviors of stock prices over time. This will make the learning more robust as well as give you a change to test how good the predictions are for a variety of situations.

Another thing to notice is that the values close to 2018 are much higher and fluctuate more than the values close to the 2012. Therefore you need to make sure that the data behaves in similar value ranges throughout the time frame. You will take care of this during the data normalization phase.

plt.figure(figsize = (18,9))

plt.plot(data["open"])

plt.plot(data["high"])

plt.plot(data["low"])

plt.plot(data["close"])

plt.title('Tesla stock price history')

plt.ylabel('Price (USD)')

plt.xlabel('Days')

plt.legend(['Open','High','Low','Close'], loc='upper left')

plt.show()

It seems the prices —Open, Close, Low, High — don’t vary too much from each other except for occasional slight drops in Low price. For simplicity, we use close price to respesent stock price on that day.

data = data["close"]Check Null/Nan Values in our data

print("checking if any null values are present\n", data.isna().sum())checking if any null values are present

0Splitting Data into a Training set and a Test set

train = data[ : "2019-01-01"]

test = data["2019-01-01" : ]

test.head()formatted_date

2019-01-02 310.119995

2019-01-03 300.359985

2019-01-04 317.690002

2019-01-07 334.959991

2019-01-08 335.350006

Name: close, dtype: float64One-Step Ahead Prediction via Simple Moving Average(SMA)

The prediction at t+1 is the average value of all the stock prices you observed within a window of t to t−N.

\[\large \hat{X}_{t+1} = \frac{1}{N}\sum_{i=t-N}^{t}X_{i}\]

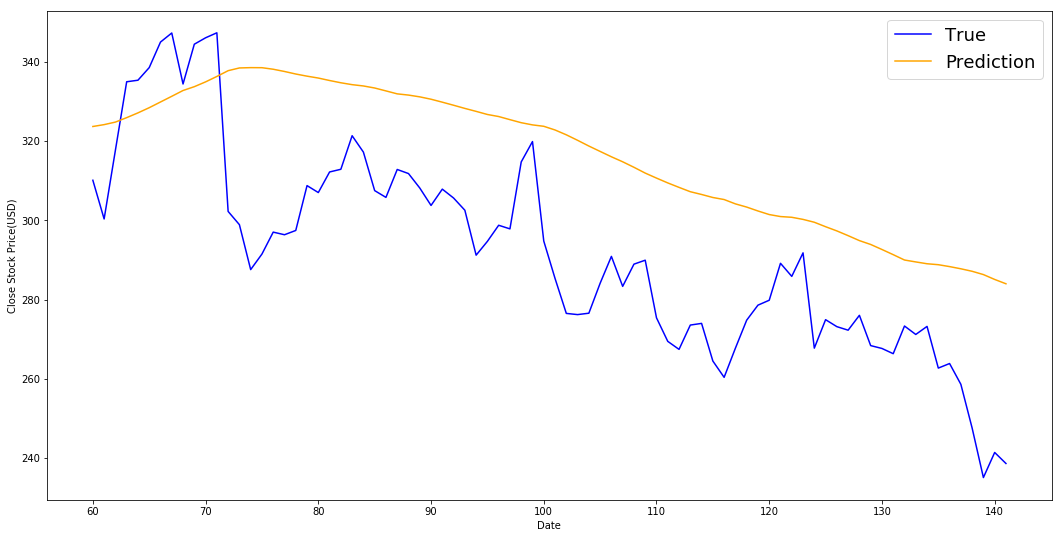

We are going to predict the ckose stock price of the data based on the close stock prices for the past 60 days.

window_size = 60

data1 = data[train.size - window_size : data.size]

N = data1.size

std_avg_predictions = []

for pred_idx in range(window_size,N):

std_avg_predictions.append(np.mean(data1[pred_idx-window_size:pred_idx]))

print('MSE error for SMA: %.5f'%(0.5*np.mean((std_avg_predictions - test)**2)))

plt.figure(figsize = (18,9))

plt.plot(range(window_size,N),test,color='b',label='True')

plt.plot(range(window_size,N),std_avg_predictions,color='orange',label='Prediction')

plt.xlabel('Date')

plt.ylabel('Close Stock Price(USD)')

plt.legend(fontsize=18)

plt.show()MSE error for SMA: 417.30120

Given that stock prices don't change from 0 to 100 overnight, prediction only capture the trend of this series while the variation information is completely missing. So this result is not satisfying.

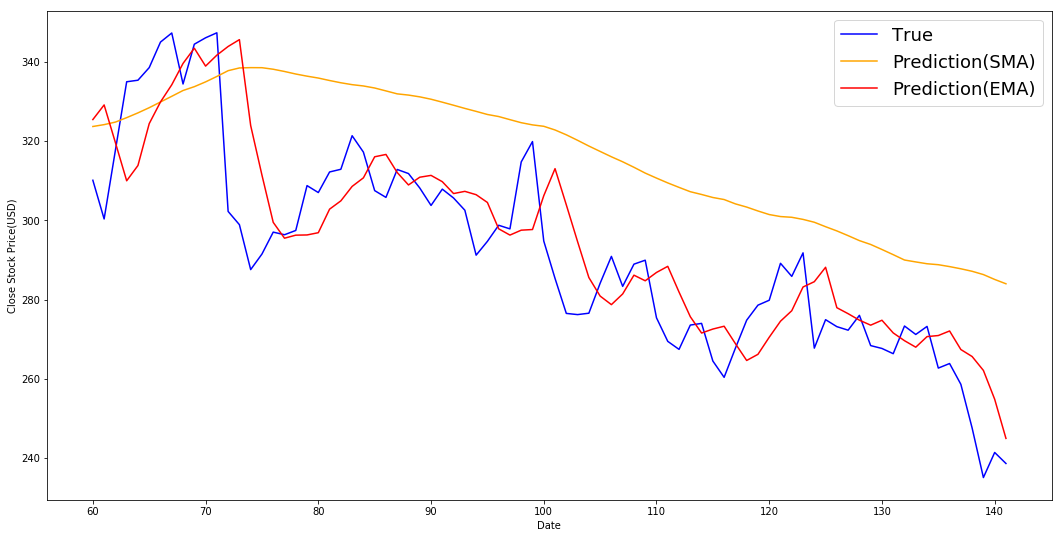

One-Step Ahead Prediction via Exponential Moving Average(EMA)

\[ \large \hat{X}_{t+1} = \text{EMA}_{t} = \gamma \times \text{EMA}_{t-1} + (1 - \gamma)X_{t} \]

The exponential moving average from t+1 time step and uses that as the one step ahead prediction. γ decides what the contribution of the most recent prediction is to the EMA, where $\text{EMA}_{0} = 0$.

exp_avg_predictions = []

running_mean = 0.0

exp_avg_predictions.append(running_mean)

decay = 0.5

for pred_idx in range(1,N):

running_mean = running_mean*decay + (1.0-decay)*data1[pred_idx-1]

exp_avg_predictions.append(running_mean)

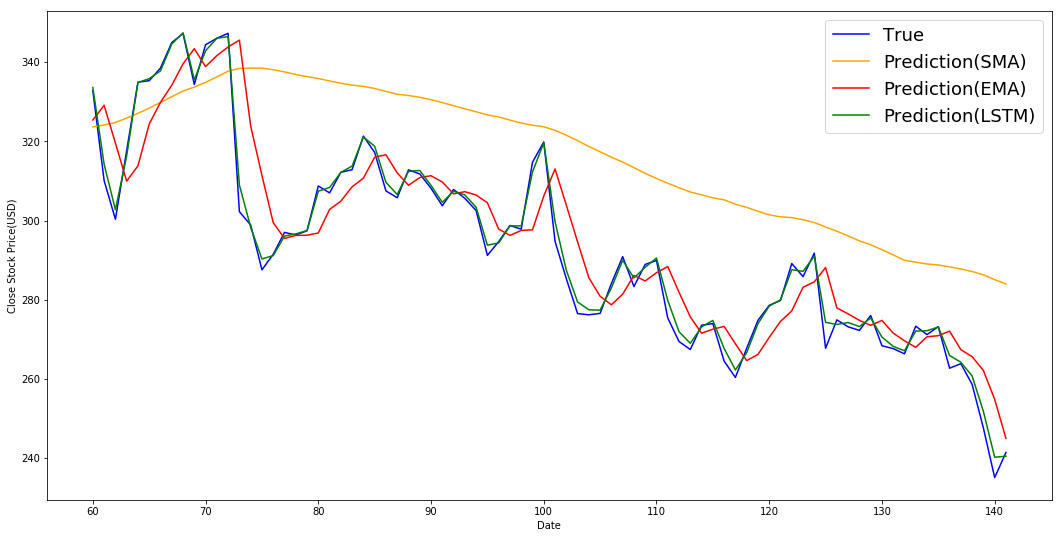

plt.figure(figsize = (18,9))

plt.plot(range(window_size,N),test,color='b',label='True')

plt.plot(range(window_size,N),std_avg_predictions,color='orange',label='Prediction(SMA)')

plt.plot(range(window_size,N),exp_avg_predictions[window_size-1:N-1],color='red',label='Prediction(EMA)')

plt.xlabel('Date')

plt.ylabel('Close Stock Price(USD)')

plt.legend(fontsize=18)

plt.show()

print('MSE error for SMA: %.5f'%(0.5*np.mean((std_avg_predictions - test)**2)))

print('MSE error for EMA averaging: %.5f'%(0.5*np.mean((exp_avg_predictions[window_size-1:N-1] - test)**2)))

MSE error for SMA: 417.30120

MSE error for EMA averaging: 100.90856The MSE of EMA is much lower than SMA, and EMA fits true times series pretty well in the sense that it capture variation of the price changes.

LSTM NN

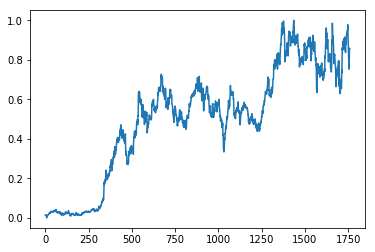

Data normalization

As a rule of thumb, whenever you use a neural network, you should normalize or scale your data. We will scale our data between 0 and 1.

data2 = train.values

data2 = data2.reshape(-1,1)

scaler = MinMaxScaler(feature_range = (0, 1))

data2 = scaler.fit_transform(data2)

data2 = data2.reshape(-1)

plt.plot(data2)[]

Data Preprocessing

features_set = []

labels = []

for i in range(window_size, data2.size):

features_set.append(data2[i-window_size:i])

labels.append(data2[i])

features_set, labels = np.array(features_set), np.array(labels)

features_set = np.reshape(features_set, (features_set.shape[0], features_set.shape[1], 1)) np.shape(features_set)(1700, 60, 1)np.shape(labels)(1700,)Training the LSTM

We need to instantiate the Sequential class. This will be our model class and we will add LSTM, Dropout and Dense layers to this model. We call the compile method on the Sequential model object which is "model" in our case. Dropout layer is added to avoid over-fitting, We use the mean squared error as loss function and to reduce the loss or to optimize the algorithm, we use the adam optimizer.

Notes: batch_size denotes the subset size of your training sample (e.g. 100 out of 1000) which is going to be used in order to train the network during its learning process. Each batch trains network in a successive order, taking into account the updated weights coming from the appliance of the previous batch.

model = Sequential()

model.add(LSTM(units=50, return_sequences=True, input_shape=(features_set.shape[1], 1)))

model.add(Dropout(0.2))

model.add(LSTM(units=50, return_sequences=True))

model.add(Dropout(0.2))

model.add(LSTM(units=50, return_sequences=True))

model.add(Dropout(0.2))

model.add(LSTM(units=50))

model.add(Dropout(0.2))

model.add(Dense(units = 1))

model.compile(optimizer = 'adam', loss = 'mean_squared_error')

model.fit(features_set, labels, epochs = 100, batch_size = 20) WARNING:tensorflow:From D:\python\lib\site-packages\tensorflow\python\framework\op_def_library.py:263: colocate_with (from tensorflow.python.framework.ops) is deprecated and will be removed in a future version.

Instructions for updating:

Colocations handled automatically by placer.

WARNING:tensorflow:From D:\python\lib\site-packages\keras\backend\tensorflow_backend.py:3445: calling dropout (from tensorflow.python.ops.nn_ops) with keep_prob is deprecated and will be removed in a future version.

Instructions for updating:

Please use `rate` instead of `keep_prob`. Rate should be set to `rate = 1 - keep_prob`.

WARNING:tensorflow:From D:\python\lib\site-packages\tensorflow\python\ops\math_ops.py:3066: to_int32 (from tensorflow.python.ops.math_ops) is deprecated and will be removed in a future version.

Instructions for updating:

Use tf.cast instead.

Epoch 1/100

1700/1700 [==============================] - 17s 10ms/step - loss: 0.0252

Epoch 2/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0071

Epoch 3/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0064

Epoch 4/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0053

Epoch 5/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0057

Epoch 6/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0051

Epoch 7/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0053

Epoch 8/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0052

Epoch 9/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0042

Epoch 10/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0041

Epoch 11/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0038

Epoch 12/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0039

Epoch 13/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0038

Epoch 14/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0038

Epoch 15/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0033

Epoch 16/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0032

Epoch 17/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0031

Epoch 18/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0031

Epoch 19/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0032

Epoch 20/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0030

Epoch 21/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0029

Epoch 22/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0026

Epoch 23/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0029

Epoch 24/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0026

Epoch 25/100

1700/1700 [==============================] - 13s 7ms/step - loss: 0.0025

Epoch 26/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0026

Epoch 27/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0023

Epoch 28/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0025

Epoch 29/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0022

Epoch 30/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0022

Epoch 31/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0022

Epoch 32/100

1700/1700 [==============================] - 13s 7ms/step - loss: 0.0021

Epoch 33/100

1700/1700 [==============================] - 13s 8ms/step - loss: 0.0021

Epoch 34/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0021

Epoch 35/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0020

Epoch 36/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0020

Epoch 37/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0020

Epoch 38/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0020

Epoch 39/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0019

Epoch 40/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0017

Epoch 41/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0018

Epoch 42/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0017

Epoch 43/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0017

Epoch 44/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0018

Epoch 45/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0017

Epoch 46/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0017

Epoch 47/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0018

Epoch 48/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0019

Epoch 49/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0018

Epoch 50/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0015

Epoch 51/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0015

Epoch 52/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0015

Epoch 53/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0016

Epoch 54/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0015

Epoch 55/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0015

Epoch 56/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0015

Epoch 57/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0015

Epoch 58/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0013

Epoch 59/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0014

Epoch 60/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0014

Epoch 61/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0013

Epoch 62/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0014

Epoch 63/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0014

Epoch 64/100

1700/1700 [==============================] - 13s 7ms/step - loss: 0.0015

Epoch 65/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0014

Epoch 66/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0012

Epoch 67/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0014

Epoch 68/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0012

Epoch 69/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0013

Epoch 70/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0013

Epoch 71/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0014

Epoch 72/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0013

Epoch 73/100

1700/1700 [==============================] - 13s 7ms/step - loss: 0.0014

Epoch 74/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0014

Epoch 75/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0013

Epoch 76/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0013

Epoch 77/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0014

Epoch 78/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0013

Epoch 79/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0012

Epoch 80/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0012

Epoch 81/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0012

Epoch 82/100

1700/1700 [==============================] - 13s 7ms/step - loss: 0.0010

Epoch 83/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0011

Epoch 84/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0012

Epoch 85/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0013

Epoch 86/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0012

Epoch 87/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0012

Epoch 88/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0012

Epoch 89/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0012

Epoch 90/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0011

Epoch 91/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0011

Epoch 92/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0012

Epoch 93/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0013

Epoch 94/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0011

Epoch 95/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0013

Epoch 96/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0011

Epoch 97/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0011

Epoch 98/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0011

Epoch 99/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0011

Epoch 100/100

1700/1700 [==============================] - 12s 7ms/step - loss: 0.0011

Testing our LSTM

test1 = data1.values

test1 = test1.reshape(-1,1)

test1 = scaler.transform(test1)

test1 = test1.reshape(-1)

test_features = []

for i in range(window_size, test1.size):

test_features.append(test1[i-window_size:i])

test_features = np.array(test_features)

test_features = np.reshape(test_features, (test_features.shape[0], test_features.shape[1], 1))

predictions = model.predict(test_features)

predictions = scaler.inverse_transform(predictions)

predictions = predictions.reshape(-1)

plt.figure(figsize = (18,9))

plt.plot(range(window_size,N),data1[window_size-1:N-1],color='b',label='True')

plt.plot(range(window_size,N),std_avg_predictions,color='orange',label='Prediction(SMA)')

plt.plot(range(window_size,N),exp_avg_predictions[window_size-1:N-1],color='red',label='Prediction(EMA)')

plt.plot(range(window_size,N),predictions,color='green',label='Prediction(LSTM)')

plt.xlabel('Date')

plt.ylabel('Close Stock Price(USD)')

plt.legend(fontsize=18)

plt.show()

print('MSE error for SMA: %.5f'%(0.5*np.mean((std_avg_predictions - test)**2)))

print('MSE error for EMA averaging: %.5f'%(0.5*np.mean((exp_avg_predictions[window_size-1:N-1] - test)**2)))

print('MSE error for LSTM: %.5f'%(0.5*np.mean((predictions - test)**2)))

MSE error for SMA: 417.30120

MSE error for EMA averaging: 100.90856

MSE error for LSTM: 48.48832Multi-Step Ahead Prediction via Exponential Moving Average(EMA)

Since you can't do much with just the stock market value of the next day, we would like to know the stock market prices go up or down in the next four months. However no matter how many steps you predict in to the future, you'll keep getting the same answer for all the future prediction steps for EMA.

To see this, Consider \(\hat{X}_{t+1} = \text{EMA}_{t} , \hat{X}_{t+2} = \gamma \times \hat{X}_{t+1} + (1 - \gamma) \times \text{EMA}_{t} = \gamma \times \hat{X}_{t+1} + (1 - \gamma) \times \hat{X}_{t+1} = \hat{X}_{t+1}\)

Multi-Step Ahead Prediction via LSTM

Long Short-Term Memory models are extremely powerful time-series models. They can predict an arbitrary number of steps into the future. I am trying to apply multiple LSTM on Tesla.

Peace!